Nearly half of Chicago adults (48%) and 40% of adults living in Chicago’s suburbs report that they spend more than 30% of their income on housing—far more than the 31% of all U.S. adults who report paying such a high percentage of their income for housing, according to MacArthur's 2016 How Housing Matters Survey. The survey, which offers both national and Chicago-area data this year, reveals the prolonged housing affordability crisis has had a profound impact, with city residents, expressing worry at higher rates that “the worst is yet to come.”

Despite pessimism and insecurity about housing affordability, Chicago residents believe the situation is solvable: 70% of city residents think a great deal or fair amount can be done. For the situation to improve, they feel that it is very important (70%) for elected leaders in Washington, DC to address the problem of housing affordability.

“Housing is more than shelter; research shows that stable, affordable housing is a lifeline to educational success, health and well-being, and economic security,” said MacArthur President Julia Stasch. “There is a solid foundation of helpful policies, but more needs to be done to preserve and increase the supply of affordable housing and to address the loss of income that contributes to increased demand.”

MacArthur, with support from the Kresge Foundation and the Melville Charitable Trust, today released its fourth annual national survey of housing attitudes conducted by Hart Research Associates. In addition to 1,200 adults interviewed across the nation between April 28 and May 10, Hart Research Associates also interviewed 303 adults in the City of Chicago and 300 adults in the Chicago suburbs. Findings from this representative sample of 603 Chicago Metro Area adults include:

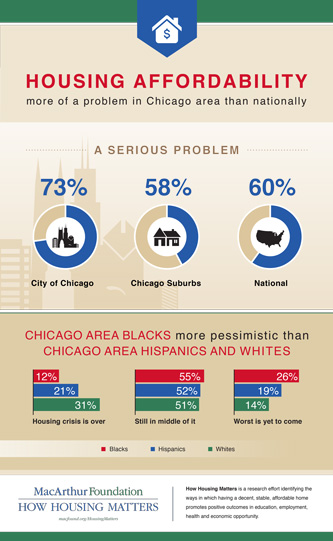

City residents, and African Americans across the Chicago metro region, are especially skeptical that the housing crisis is over. Three-quarters of city residents believe “we are still in the middle of it” (47%) or “the worst is yet to come” (28%). By comparison, 66% in Chicago’s suburbs believe the same (54% still in the middle, 12% worse yet to come), as do 63% of adults nationally (44% still in the middle, 19% worse yet to come). Renters in the city of Chicago are especially wary: 33% believe the worst is yet to come, compared to 18% of city homeowners. Among African-Americans in the city and its suburbs, only 12% believe the housing crisis is over, and more than double that proportion (26%) believe the worst is still to come, with 55% believing we are still in the middle of the crisis; this compares to 21% of Hispanics and 31% of whites who believe the crisis is over, 19% of Hispanics and 14% of whites who think the worst is yet to come, and 52% of Hispanics and 51% of whites who believe we are still in the midst of it.

Homeowners in Chicago’s suburbs are among the few who are more likely to believe that the housing crisis that began nearly a decade ago is over (34%), compared to only 18% of city residents. While the rest of the nation may be looking at homeownership with renewed interest, Chicagoans are still torn. Chicago adults are divided between thinking that buying a home is an excellent long-term investment (45%) and believing this is no longer the case (41%). Adults in Chicago’s suburbs are similarly torn (41% - 43%). In contrast, nationally 60% in 2016 believe that buying a home is an excellent long-term investment, while only 33% disagree.

Like Americans nationally, residents in the Chicago area struggle to keep up with their housing costs and many are falling behind, with increasing difficulty in finding affordable housing. Having stable housing that is affordable is a very important part of having a secure, middle-class lifestyle, say 87% of area adults; yet a large majority (67%) believes it is harder today to find stable, affordable housing than it was for previous generations. Adults in Chicago are less likely to say their current housing situation is very stable and secure (40%) than residents of Chicago’s suburbs (52%). In fact, more than one in five area adults (22%) feel either only somewhat stable and secure or unstable and insecure about their housing situation. This housing vulnerability impacts some segments of the population at even higher rates, including 30% of city residents (compared to 18% of suburban residents), 33% of Hispanics, 35% of African-Americans, and 37% of people in the metro area with incomes less than $40,000. Chicago-area renters feel less stable, with 35% feeling either only somewhat stable and secure or unstable and insecure (including 36% of renters living in the city). Adults living in the city (63%) are more likely to have had to make personal sacrifices to pay their rent or mortgage in recent years than those in Chicago’s suburbs (52%) or nationally (53%). In a further indication of why Chicago area residents indicate feelings of insecurity about their housing situation, 38% of both city and suburban residents report they or someone they know has been evicted, foreclosed upon, or lost housing in the past five years compared to 34% nationwide.

Chicago’s residents are more likely to view housing affordability as a serious problem in America today. City residents view it as a serious problem (73%), compared to residents of Chicago’s suburbs (58%) or nationally (60%). When asked whether housing affordability is a problem in their own area, Chicago residents are significantly more likely to say it is a serious problem (52%) than those in the city’s suburbs (37%) or nationally (39%).

African-American residents in Chicago and its suburbs have been especially hard hit by the ongoing housing crisis and have a more pessimistic outlook. Sixty-three percent of African Americans believe that housing affordability is a serious problem in their community, compared to 39% of whites. Three in four African-Americans (76%) believe that it’s harder today to secure stable, affordable housing than it was for previous generations, compared to 64% of white Chicago-area residents. While 36% of white residents spend more than 30% of their income on their rent or mortgage, more than half of African Americans (57%) say they do, which makes it unsurprising that 70% of African Americans report having made at least one sacrifice in the past three years to pay for housing compared to 51% of whites. Moreover, nearly half of African Americans (46%) have themselves been or know someone who has been evicted, foreclosed upon, or lost their housing in the past five years, compared to 38% of white Chicago-area residents.

Chicago-area residents want to see action on the affordable housing crisis and believe that it is possible to solve this problem. While majorities of adults in Chicago’s suburbs (64%) and nationally (63%) believe that a great deal/fair amount can be done to solve the problem of housing affordability, Chicago residents are even more confident (70%), with 44% believing a great deal can be done. This includes solid majorities of Democrats (75%) and Independents (62%) and over half of Republicans (53%) across the metro region. African-Americans, in particular, express optimism that actions can be taken to solve the problems of housing affordability, with nearly eight in ten believing a great deal (56%) or a fair amount (22%) can be done to solve the problem; by comparison, 26% of whites believe a great deal can be done and 35% believe a fair amount can be done to solve the problem. Seventy percent of Chicago residents say that it is very important for elected leaders in Washington to address the problems related to housing affordability, compared to 57% in Chicago’s suburbs and 60% nationally. Across the city and suburbs, eight in ten African-Americans (79%) believe it is very important for their elected officials in Washington to address problems related to housing affordability, compared to 56% of whites who feel the same. When it comes to the 2016 presidential campaign, 72% of city residents say this topic is not getting enough attention, and 58% of suburban residents indicate housing affordability has not yet been sufficiently addressed by the candidates.

When presented with policy approaches that might address the affordable housing crisis, Chicago-area residents favored a variety of policies that could be implemented by the federal, state, and local governments. These policies include tax incentives for middle-income families to purchase homes (85% city, 80% suburbs favor); targeting subsidies for low-income families with children (88% city, 76% suburbs); and allowing developers to build more units if they make a certain number affordable to families making less than median income (84% city, 81% suburbs).

“The challenges of affordable housing, and their impact on one’s feelings of security and ability to achieve the American Dream, are even more intense in Chicago than in its suburbs or the nation as a whole. At the same time, Chicago’s residents are more optimistic that leaders can fix housing affordability problems, and that they need to do so,” said Geoffrey Garin, President of Hart Research Associates.

With grants and impact investments totaling $385 million, MacArthur has pursued a goal of access to stable, decent homes for the greatest number of low- and moderate-income American families through more balanced national, state, and local housing policy. In Chicago, the Foundation created and supported The Preservation Compact, an initiative of public, private, and nonprofit organizations whose goal is to preserve affordable rental housing in Cook County in neighborhoods distressed by foreclosures, condominium conversions, demolition, and rising costs. MacArthur currently provides support to affordable housing programs and research at the Chicago Community Loan Fund, the Community Investment Corporation, Neighborhood Housing Services of Chicago, Mercy Housing Lakefront, Elevate Energy, and the DePaul Institute for Housing Studies.