What is the Catalytic Capital Consortium?

When should investors consider using catalytic capital?

How can catalytic capital help enterprises and sectors grow and scale?

Why is catalytic capital important now?

What Is Catalytic Capital?

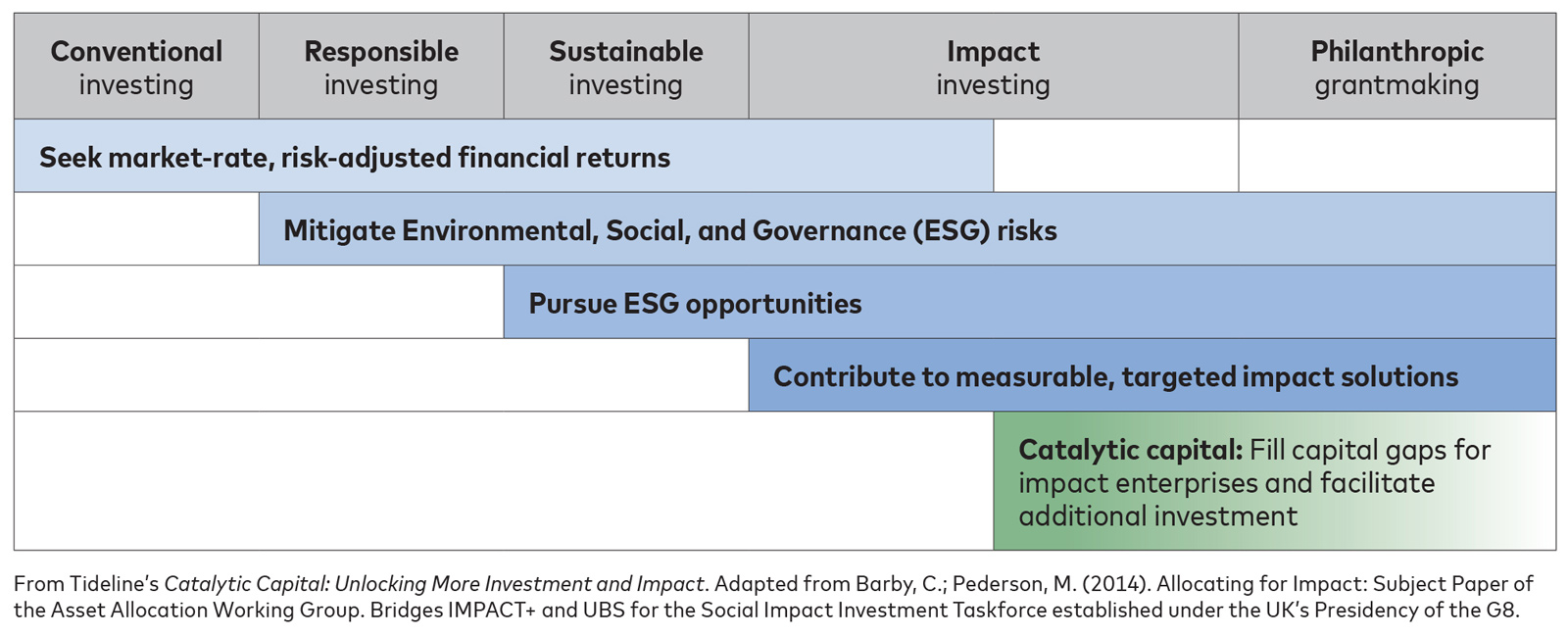

Catalytic capital is a subset of the full continuum of capital – investments that are more patient, risk-tolerant, concessionary, and flexible than conventional capital.

Impact investing is growing rapidly. More investors are deploying capital aimed at positive, measurable, social, and environmental impact and aligned with a financial return. There is also growing recognition that impact investments must span a spectrum of risk-return profiles, with a range of capital needed to ensure impact investing realizes its full potential in helping address some of the world’s most critical challenges.

Catalytic capital is an essential tool to bridge capital gaps and achieve breadth and depth of positive impact. It complements conventional investing and can take the form of debt, equity, or guarantees. Catalytic capital is often needed when enterprises, fund managers, or markets are untested, have smaller margins due to the low incomes of the people they serve, operate at limited scale, face political or economic challenges in the places where they operate, or are subject to other constraints.

Catalytic capital can help impact-driven enterprises and funds drive innovation, build a track record, leverage additional investment, signal impact potential, and safeguard mission.

For more information: Tideline’s report Catalytic Capital: Unlocking More Investment and Impact

What Is the Catalytic Capital Consortium?

The Catalytic Capital Consortium is a new investment, learning, and market development initiative bringing together leading impact investors who believe that greater, more effective use of catalytic capital is an essential component of achieving the UN Sustainable Development Goals (SDGs) and realizing the full potential of the impact investing field.

The Catalytic Capital Consortium will help more funds and social enterprises attract the financing they need to address some of the world’s most pressing challenges and spur learning about catalytic capital in the impact investing community. The initiative aims to demonstrate the power of catalytic capital to extend and deepen the reach of the impact investing field.

As part of the initiative, MacArthur is dedicating up to $150 million in investments on a matching basis to approximately five funds or intermediaries that demonstrate a powerful use of catalytic capital across sectors and geographies. For enterprises, fund managers, and markets, MacArthur’s catalytic capital can play a de-risking role and help build track records as well as scale, ideally setting the stage for other impact and conventional investors to provide more capital either concurrently or in the future.

MacArthur’s first investment is $30 million to expand and accelerate The Rockefeller Foundation’s Zero Gap initiative. The investment marks a unique impact investing collaboration between two foundations,where each will invest $30 million with the aim of catalyzing at least $1 billion in new capital to help meet the SDGs. These funds will be managed by The Rockefeller Foundation’s new impact investment management platform, Rockefeller Foundation Impact Investment Management, which aims to tap into mainstream markets and investors, scaling up investments into promising new finance vehicles that help to close the SDG funding gap.

The Rockefeller Foundation and Omidyar Network join MacArthur as strategic partners in the initiative and will help evaluate investment proposals, drawing on their extensive impact investing experience. The three partners will also collectively provide an initial $10 million in grants to fuel learning and market development related to catalytic capital, helping to answer critical questions about the scope of the need for catalytic capital, when and how catalytic capital can be most effective, and what additional tools and practices are needed.

More information on the Catalytic Capital Consortium’s investments and grantmaking will be announced later this year.

When Should Investors Consider Using Catalytic Capital?

Catalytic capital is well-suited for investors who want to support enterprises or funds that have high-impact potential but struggle to raise suitable financing because they are too early-stage or otherwise risky, expect to generate only modest returns, or require a longer investment time horizon. Catalytic capital can help enterprises and funds drive innovation, build a track record, leverage additional investment, signal impact potential, and safeguard mission.

A wide range of investors and fund managers have deployed catalytic capital, including foundations, high net worth individuals and family offices, community development finance institutions, development finance institutions, and, in some circumstances, institutional investors.

Catalytic capital is not appropriate for all impact investors and is not a panacea for all charitable, social, or environmental issues. However, for many investors’ portfolios, it can play a critical role in increasing breadth and depth of positive impact.

How Can Catalytic Capital Help Enterprises and Sectors Grow and Scale?

Catalytic capital can bridge financing gaps that have left investors on the sidelines and prevented impact-driven enterprises and funds from receiving the capital they need to grow and succeed. It can be used to provide support at various stages of an enterprise’s or fund’s lifecycle, including:

- Seeding: Providing early-stage capital where there may be uneven cash flows, longer runways to profitability, or modest operating margins.

- Scaling: Helping impact enterprises realize economies of scale and reach new geographies and population segments. Catalytic capital that aims to de-risk and leverage investment from other investors can also be critical to supporting scale.

- Sustaining: Accepting appropriate concessionary returns if required to allow an enterprise or fund to fulfill its goal of reaching vulnerable beneficiaries or to otherwise operate a business model that is not yet commercially viable but will similarly reach vulnerable beneficiaries when viable.

Additionally, catalytic capital has the ability to achieve systemic impact. Read Omidyar Network’s Across the Returns Continuum report to learn about the relationship between catalytic capital and market-level impact.

Why Is Catalytic Capital Important Now?

This is a unique and urgent moment for the increased use of catalytic capital, underscored by several converging trends across finance and global development.

With more than $228 billion in impact investing assets today, there is tremendous opportunity in the growing impact investing field. However, only an estimated five percent of these assets are allocated to below-market investments (an important form of catalytic capital), which can support enterprises generating significant positive impact in areas such as poverty reduction, education, affordable housing, climate change, and more. High-impact enterprises and funds that support them often struggle to access appropriate financing because of disproportionate risk or concessionary returns.

For the impact investing field to realize its full potential for people, communities and the planet, the use of catalytic capital needs to increase and be applied to an ever-wider range of social, environmental, and economic problems.

This is particularly true given the estimated $5 trillion to $7 trillion financing gap annually that hinders society’s ability to achieve the SDGs by 2030. In many cases, catalytic capital can spark the entry of conventional capital, simultaneously or subsequently, and has the potential to help drive more capital to the SDGs.

The good news is that there are several positive indicators for catalytic capital’s growth:

- An estimated $30 trillion of wealth will be passed down from baby boomers over the next 30 years to younger generations who, research reveals, are eager for a range of investing opportunities, particularly those that maximize breadth and depth of impact.

- Blended finance, a structuring approach that usually includes catalytic capital, is attracting substantial visibility and attention. On the Convergence platform alone, there are $4 billion in emerging market blended finance structures seeking capital, with approximately $500 million in catalytic capital required.

- Catalytic capital has been deployed successfully by a small percentage of impact investors for decades. Sharing data, learnings, tools, and practices can help create even more collaboration with the impact investing community around both the use of catalytic capital and its synergy with other forms of investment across the full continuum of capital.

How Can People Get Involved?

We encourage investors, entrepreneurs, advisors, researchers, and others to join us in expanding catalytic capital investment and learning.

- Share your experiences with catalytic capital, including how you’ve invested or benefited from catalytic capital and lessons learned.

- Ask questions and propose research topics related to catalytic capital.

- Request information on how catalytic capital is being used today and where more is needed.

Sign up to receive email updates ›

Join the conversation on social media with #CatalyticCapital.